1. Manual P2P Procedures

Manual and paper-based P2P processes come with many challenges, including inefficiency, inaccuracy, and significant overhead. Few companies have the resources to manually manage paper orders and invoices, update spreadsheets, validate data, and fix inaccurate data. This becomes especially challenging in times of supply chain volatility and at month-end, quarterend, and year-end. Manually approving POs and invoices, validating contracts, and fixing spreadsheets can take significant time and resources. It’s also prone to human error—an issue that P2P automation can help eliminate.

2. Limited Spend Visibility

As a procurement leader, your spend visibility is often blocked, meaning you can’t make the strategic decisions that will accelerate your company’s performance. The biggest culprit? Maverick spend may cloud your spend visibility the most.

If employees are purchasing products outside of your approved channels, it’s difficult—if not impossible—to see where your money is flowing. Without a clear picture of how money is being spent with suppliers, procurement can’t see new opportunities for discounts or how much they’re saving through strategic sourcing.

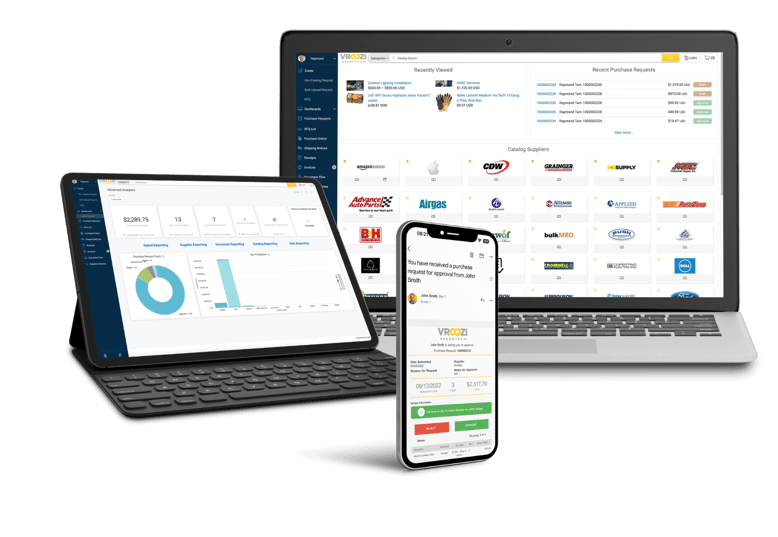

P2P automation encourages employees to purchase products within an approved digital marketplace, upping your managed spend. That means all of your company’s purchases go through pre-approved suppliers. It also bursts your spend visibility wide open.

Simply put, you achieve higher levels of spend control through P2P automation. In turn, your organization can see where, when, and with whom its money is spent. This transparency reveals insights into current and historical spend, equipping CPOs and CFOs to make better decisions about working capital investments, budgets, suppliers, and more.

3. Delayed Payments and Missed Supplier Opportunities

Only 24 percent of businesses that manually process less than 20,000 payments annually can pay all their PO invoices on time. Unfortunately, every late payment could sour your company’s relationship with suppliers, limiting your opportunities for innovation, process improvement, discounts, or other supplier perks.

Payment delays most often form because accounts payable (AP) is overloaded. Any time a non-PO invoice flows in—which includes 50 percent of invoices, according to internal estimates—your AP department has to manually type in data, search for accounting codes, and track down approvals. Worse yet, invoices don’t match or are missing data more than a quarter of the time. Plus, any time AP has to type in invoicing data manually, they risk making additional errors that hold up the payment process even more.

P2P solutions automate invoicing so employees don’t have to enter data from paper-based or emailed invoices. Advanced AI technology automatically extracts data from these invoices to enter them into your digital system. What’s more, a platform like Vroozi can code invoices for accounting or match them with their corresponding purchase orders. That all speeds up payment, improves your relationships with suppliers, and frees you up to spend time on high value invoices and watch for fraud.